Dear Friends of The Denver 100:

The Denver 100 provides this Annual Real Estate Report as a service to our clientele. Our goals are to share the current trends in the Denver residential real estate market and help predict the future housing direction in our marketplace.

Residential Real Estate Report

Denver Metro Area Single Family Housing

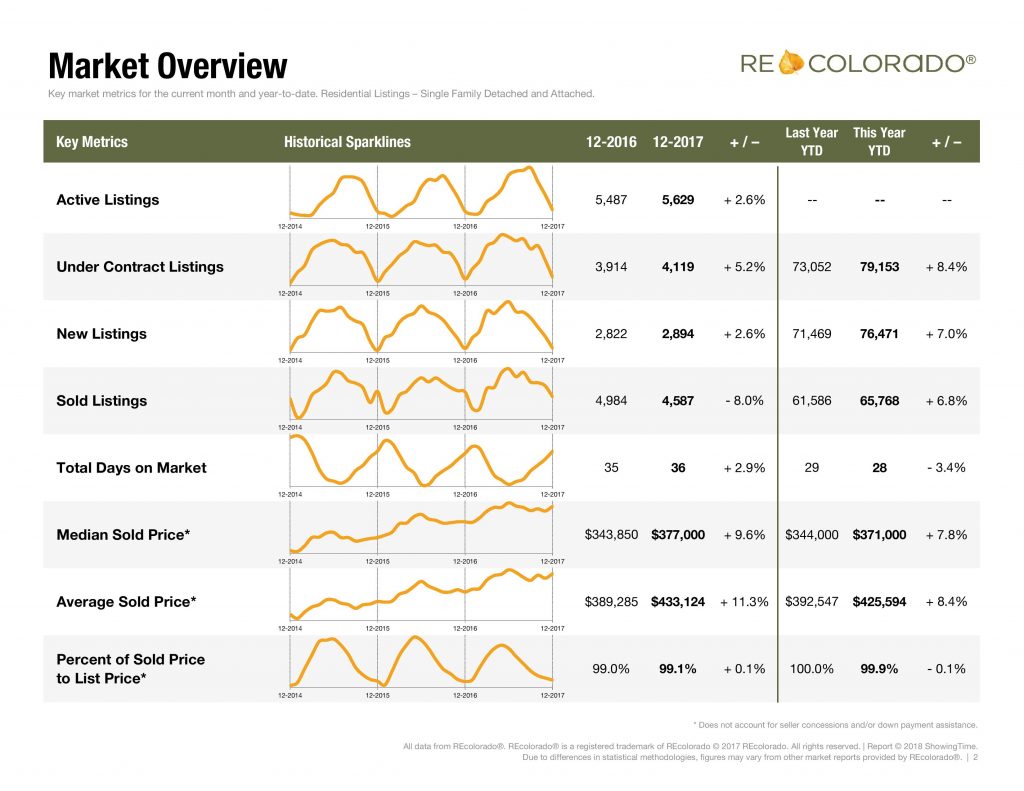

- 65,768 single family and condominiums sold in 2017 compared to 61,586 sold in 2016, or a 8% increase in the number of homes closed.

- At year end 2017, there were 5,629 active detached homes for sale compared to the beginning of 2017, which had 5,487 – an increase of 6% in inventory over last year this time.

- The average price of a single family home in the Denver Metro area ending 2017 is $425,594 compared to $392,547 ending 2016, which is an 8.4% increase in price for the mix of properties sold. By comparison, 2016 had a single family average price in Denver of $317,112.

- The average days on the market for 2017 is 28 compared to 29 one year ago.

- The selling price obtained compared to list price is 99%, which means that buyers were willing to pay full price or more to buy a home in 2017.

- The absorption rate for single family homes in the Denver Metro area with 2017 year-end inventories is 1.02 months. As the inventory decreases, so does the absorption rate. This inventory month supply will rise during the spring and summer seasons.

- The $250,000 to $500,000 price range had the most detached home sales with 27,282 homes closed in 2017, creating an absorption rate of 12 days of inventory. Below 6 months of inventory typically indicates prices will increase.

- Conversely, the $1 million and above price range had a total of 1517 homes closed in 2017, creating a current absorption rate of 9 months of supply. This is a decrease of 36% from 12 months ago, and moving in the right direction to have luxury properties start to increase in price for the first time in 8 years.

For the full report, click HERE.

2017 Highlights and 2018 Predictions for Denver Real Estate for the 8 county Denver Metro Areas

- Sellers continue to be in the drivers’ seat in the sale negotiations of homes especially priced below $500,000.

- The briskness of sales and the amount of buyers buying started to slow down in 2017 and a more normal trend of homes taking a little time to sell is now happening vs. the last 3 years. The inventory continued to remain at lower levels during the year and although we are still at record level low inventory, buyers are not as willing to jump into the bidding war process and are taking a little longer to buy.

- The increase in home prices across the metro area gain has helped people feel a little wealthier as more homes have more equity than they have had over the last 9 years.

- 2017 sold data for the 8 county Denver Metro Areas reflects 41,071 single family units closed this year compared to 43,636 homes in 2016. This 6.2% decrease indicates sales for the Denver Metro area are stabilizing and does indicate a more conservative growth moving forward into 2018.

- The number of attached units closed data for 2017 is 16,637 This is a 3% decrease over 2016, which recorded 17,141 attached units closed. Clearly the decrease in attached unit sales remained the alternative choice of buyers as the average sales price for Denver single family house is causing buyers to move to attached units at a price point they can afford.

- The number of sold properties in Denver for 2017 priced below $500,000 is 43,655. Homes priced below $500,000 make up 76% of all the sales in Denver.

- All Properties priced above $500,000 that sold in 2017 is 14,053 homes/condos compared to 2016, which had homes/condos sold of 12,763 or a 10% increase in sales.

- Attached home sales in 2017 recorded 637 units sold. Most of the sales of condos were under $500,000, making up 89% of all the condos sold.

- Average price is the third highlight of 2017, marking a strong increase to recapture lost equity in homes.

- The median price of detached homes and attached homes by the end of 2017 is $371,000 compared to $344,000 at the end of 2016, or an 6% increase.

- Price rises when days on the market shortens because buyers are making a more aggressive buying position. The days on the market in 2016 was 29 days for a home and today it is 28 days, or virtually no change in days on the market. However, we have noticed in the 4th quarter of 2017 that the days on the market increased to 36 days, indicating that buyers are taking longer to make a buyer decision and the trend most certainly is elongating the days on the market.

Three future thoughts about where 2018 housing market will be.

- Inventories will start to rise over 2017 levels, except for the hottest neighborhoods in Denver. The reason for an increase of the inventory in the housing market is because an increase of equity in the real estate market has occurred over the last several years, which is giving the freedom for a segment of sellers to place their home on the market and move. Today’s home prices have more than offset the negative adjustments made during the 2008 to 2012 years. There are a sufficient number of households who could not take advantage of refinancing at the lower interest rates and may consider selling now that they have a chance to get out without bringing cash to closing. Finally, unemployment for 2018 is going to continue to be lower than the national average as we anticipate unemployment to be in the 4% range for the upcoming year, which brings some additional buyers to the buyer pool, creating a situation for sellers to continue to capture the right buyer for their home.

- Sales will decrease slightly for 2018, with sales to be approximately 55,000 single family and condos sold. The first half of 2017 experienced a continued abnormal amount of buyers entering the market due to low interest rates, stability in their personal economic situation, and housing prices that were at 2006 levels. As the inventory of single family and condo homes closed in 2017 increases year over year, 2018 will be 2-3% less in number of units closed, which would still make 2018 one of the highest number of sales in a decade.

- The primary reason the housing market will see fewer buyers in 2018 is that

- Interest rates will be higher than today and we predict 4.4% to 4.6%.

- The easing of the borrowing guidelines still requires such rigid proof of ability to buy that self-employed or newly employed workers do not meet most of the guidelines, causing the buyer pool to retreat some in 2016.

- The inventory of properties continues to remain lower than normal, causing buyers to rent versus buy in 2018. This all means that the number of units predicted to close will be less than 2017..

- The primary reason the housing market will see fewer buyers in 2018 is that

- Prices of homes below $500,000 will increase 3-4% in 2018 depending upon the location. We do not see pricing going down unless an economic disaster occurs in a local market. For example, if DIA closed a significant part of their operations the housing around DIA would become less attractive and prices would fall. Prices above $500,000 are finally on the rise. We see prices rising up to $2M depending upon the geographic location of a home. Location in upper end priced homes will really dictate the increase. For example, a $750,000 home in Cherry Creek is liable to go up at a faster rate than the same $750,000 home in the suburbs of Douglas County. Why would this be? It goes back to the comfort level of the buyer pool who will pay more for location than worry about value. With interest rates, even for jumbo loans at low levels, some buyers who have economic stability in their life can see a bargain even at higher prices due to location. The luxury market is improving and will slowly have appreciation, especially in the suburbs. Buyer behavior has changed and buyers are more interested in convenience than mega mansion size. Hence housing in Denver moves faster than in Evergreen, for example, due to location and newer styles of homes.

- The first time home buyer pool will increase in 2018, as millenials find stability in jobs, relationships, and reduce personal debt.

Thank you for allowing The Denver 100 to be your resource for The Denver Housing Market. We are grateful for the opportunity to serve your real estate needs in 2018.