Denver is Still the Place to Live as an Investment!

You Bet It is When it Comes to Owning Real Estate.

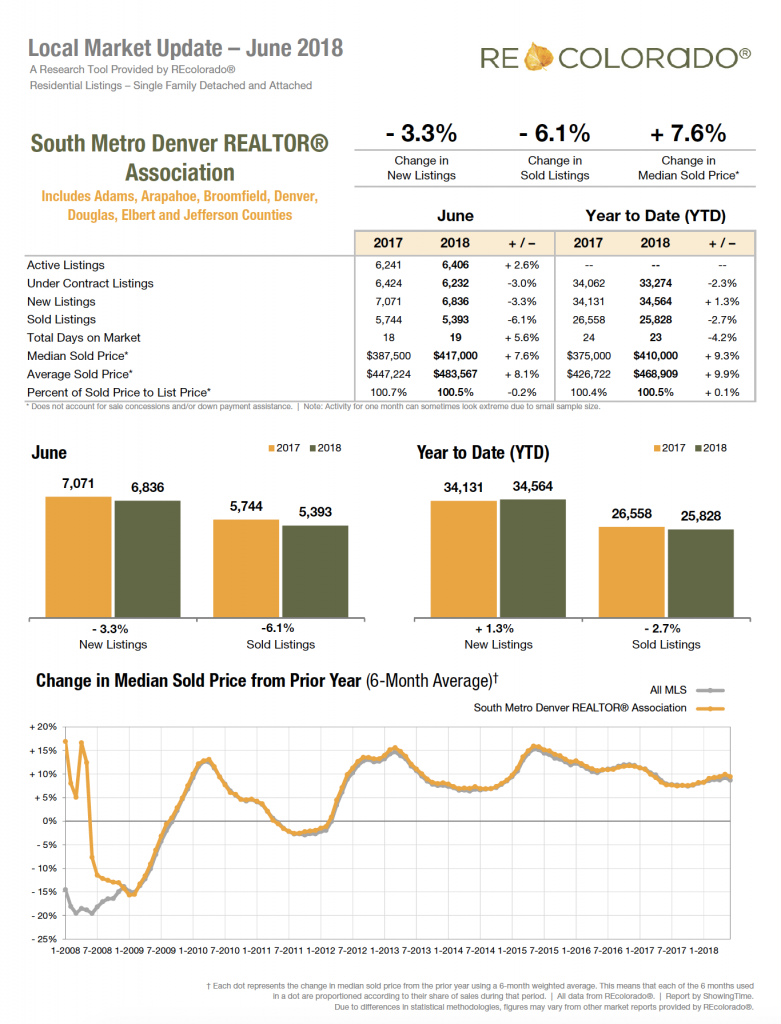

All data taken from REColorado, on July 16, 2018. Denver, Colorado. All data taken from the 8 county Denver Metro Area only.

- Average Price of both Single Family homes and Condominium homes’ Year over Year in June recorded a price of $483,567. Prices are still rising as we are now closing contracts that were written in March and April of this year.

- Inventory for June 2018 increased 18.68% over May. This means the pace of sale will start to slow down as buyer have more choices.

- The number of homes attached and detached that were Under Contract in May was 7593 and in June 2018 decreased to 6881, a significant decrease in the number of properties placed under contract. This is the future pipeline of closings to occur. Since this is a trend that is decreasing, the market will slow down in the aggressiveness of the last 5 years, but still remain a very strong market as the inventories are historically low.

- Days on the Market to Sell a Home remains approximately the same from the previous month and should continue to be in a sellers advantageous position to sell a home quickly.

How to Navigate a Changing Real Estate Market!

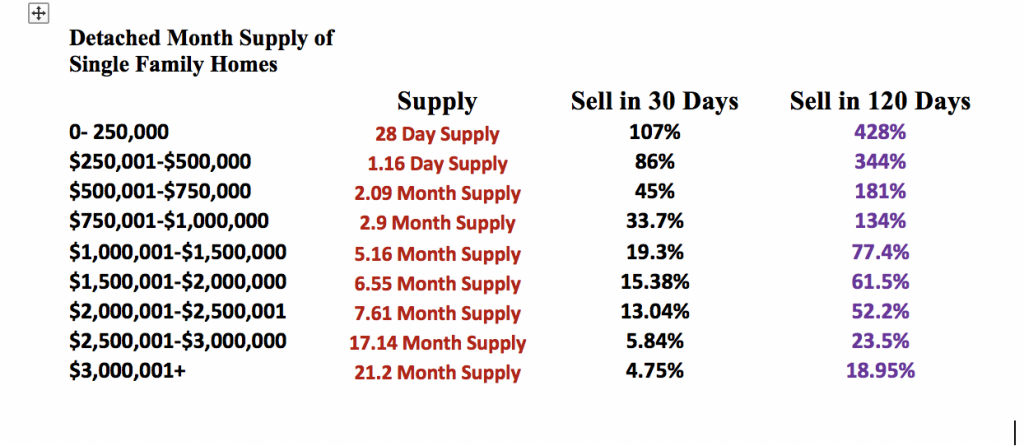

Depending upon whether you are buying or selling, you need to know how your price range is reacting to the new market trends. Here’s a Month Supply Chart and the Odds of Selling a Home. These facts can tell buyers how to make offers and tell sellers how to price their home. Remember improving your odds of competing for homes or selling your home is the most important aspect of navigating in a changing real estate market. Talk to your Denver 100 Real Estate Broker for strategies and ideas to best navigate today’s Denver real estate market. (For Attached Monthly Supply of Homes contact your agent.)

What Should Buyers Do in Today’s Market?

- Know the trends of the neighborhood you are considering. Each neighborhood has its own unique characteristics. Know the Data before buying.

- How Long will you live in your Next Home? This is an important question in a growing inventory marketplace. If you plan on living in the home 3 years, you want to make sure there is still an upside of value and tax savings for you. If you are considering a shorter term in your home, consider an adjustable rate fixed for 5 years. If you plan on staying longer consider a 15 years amortized loan.

- We are approaching a market where you, as buyers, will be able to include some terms as part of your purchase. Terms far outweigh price in most cases.

What Should Sellers do in Today’s Market?

- Be positioned as the best conditioned home. You will get top dollar this way.

- As you will have more competition, now is the time to really know where to price your home. The best way to continue to attract multiple buyers is by choosing a price position below other sales from the last 90 days. This will cause you to be in a high demand situation vs. sitting on the market with a price that may be too high in the eyes of the buyers.

- It’s July, make your exterior sparkle and trim the trees with our very wet spring season causing everything to grow beyond normal limits.