As the year ends, what will an increase in interest rates do to the Denver housing market?

As we roll into the final month of the year, investors wonder whether the Fed is going to raise interest rates and spoil the party or keep rates the same and deliver a holiday surprise. There is a lot of concern that a rate hike will hurt interest-rate sensitive assets such as housing. The US dollar would likely rise on the back of even more favorable interest rate levels versus global currencies. By extension, commodities such as oil and gold would probably fall even further. The million-dollar question is, what does the market expect will happen on December 16 when the Fed has a chance to act?

So what about interest rates? Are the odds built into the market or should we expect that markets will only reflect the impact of an interest rate hike after the Fed actually moves? Let’s take a look at how the short end of the Treasury Bond market has responded to increased expectations that the Fed will raise interest rates: Here’s a historical chart of the odds of a rate hike.

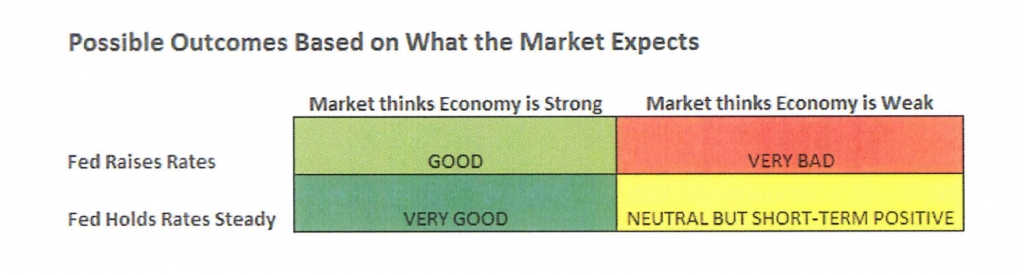

As you can see, as the odds of an interest rate hike rose, the Treasury bond market responded by moving down (bond prices move opposite to interest rates). In other words, the increased fears of a rate hike are almost completely discounted in the market already. This means that the impact of a rate hike when the Fed actually moves will be either muted or the opposite of what investors actually expect. Should the Fed surprise everyone by holding rates steady, it stands to reason that bonds would perform extremely well. On a day-to-day basis, what we are seeing in the bond market’s response to different economic announcements are changes in expectations of whether or not the Fed will hike. Furthermore, when we look at the stock market we are seeing yet a further layer of expectations – If the Fed raises rates, then what will the impact be on the economy (good or bad) in the future?

What About Housing in Denver with a Rate Hike?

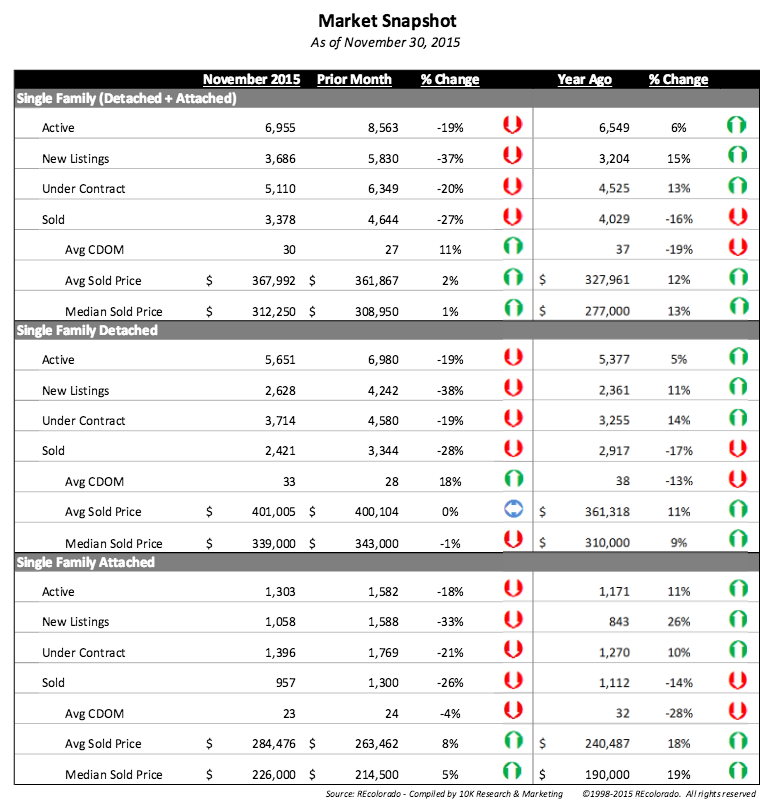

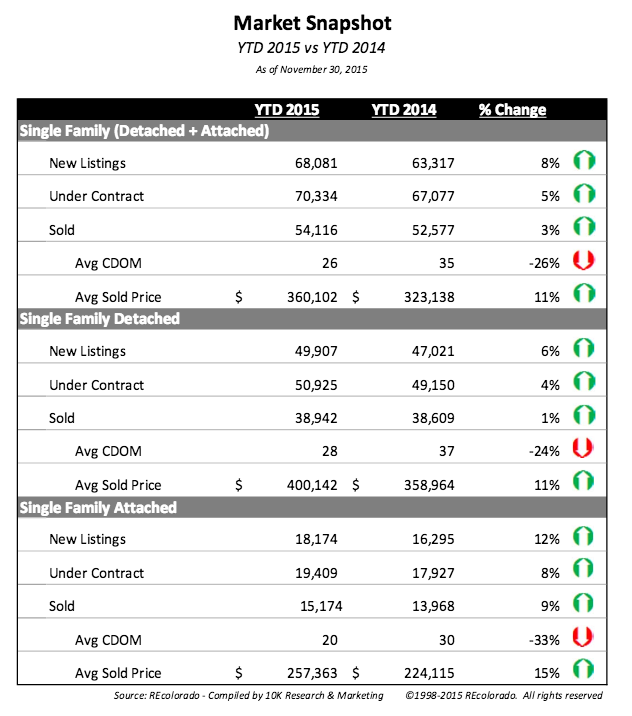

- December 2015 inventory is 6% greater than 12 months earlier. Still relatively low inventory for a market Denver’s size.

- The number of properties sold in November of 2014 compared to November of 2015 is down 16% year over year. Buyers are not entering the market as quickly.

- The average price of a single family home today is $401,005 compared to $361,318 one year ago. An 11% increase. Prices are at an all time high and will not continue this rapid appreciation experience the last 24 months.

- The average price of a condominium is $284,476 today compared to $240,487 one year earlier or an increase of 18%.

- The Days on the Market has decreased 19% over one year ago and today stands at 27 days on the market.

Three Factors to Watch regarding a rate hike for real estate:

- The market has such low inventory a small rate hike will not change the buyer behavior in buying a home the early part of the year and could cause a rush to buy.

- The overall economy remains strong in Denver, providing new buyers accessing the housing market to continue to fuel having more buyers than homes available.

- Any rate hike will slow price increases down to more manageable levels as 1% rise in interest rates decrease a buyers’ buyer power by 10%.

Look for our Year End Report for 2015 in the middle of January 2016 and request a full report from your broker at The Denver 100, LLC.

Happy Holidays!

So, How’s the Market, December 2015 | Data taken from REColorado on December 10, 2015 for the 8 county Denver Metro Area and commentary taken from Legacy Wealth Partners, Denver CO.