We are now moving toward a more normal market for sales of homes. We are getting enough data together to predict that 2016 will be a little slower in sales than 2015 was. Of course, 2015 was the highest recorded real estate sales year ever, so real estate is still a great investment in Denver.

We still show, statistically, that homes priced under $500,000 in the 8 county metro area, still record only a 1.3 month’s supply of homes, and a 6 months’ supply would make it a balanced market! So, still looks pretty active for the next 6-12 months. If you are considering buying or selling, now is a very attractive time to take advantage of the low rates today.

Inventory Increasing, Sold Data Decreasing. What Does This Mean for Residential Real Estate in Denver?

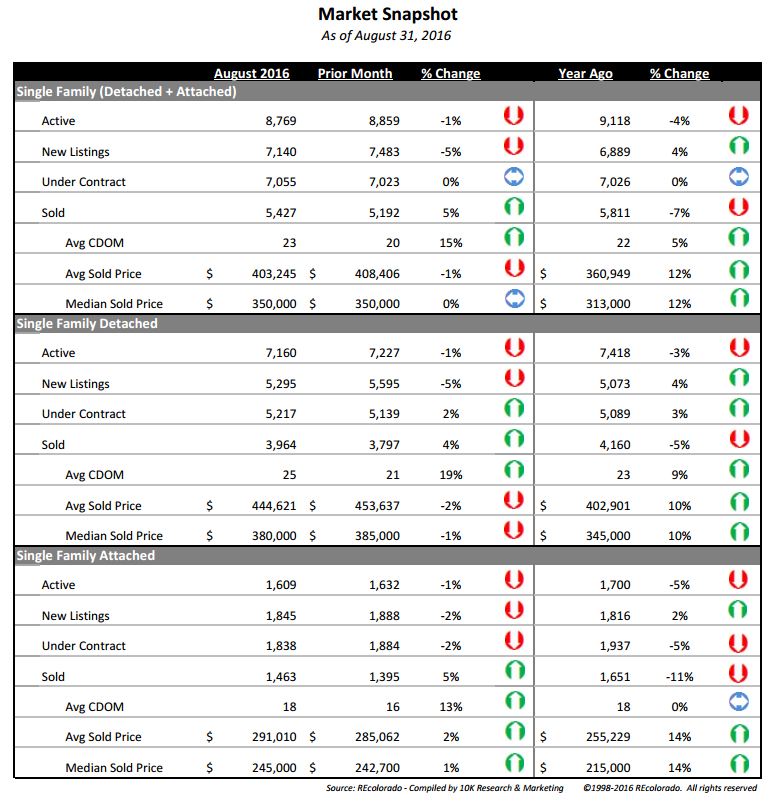

- Listing Inventory is 4% more today than one year ago.

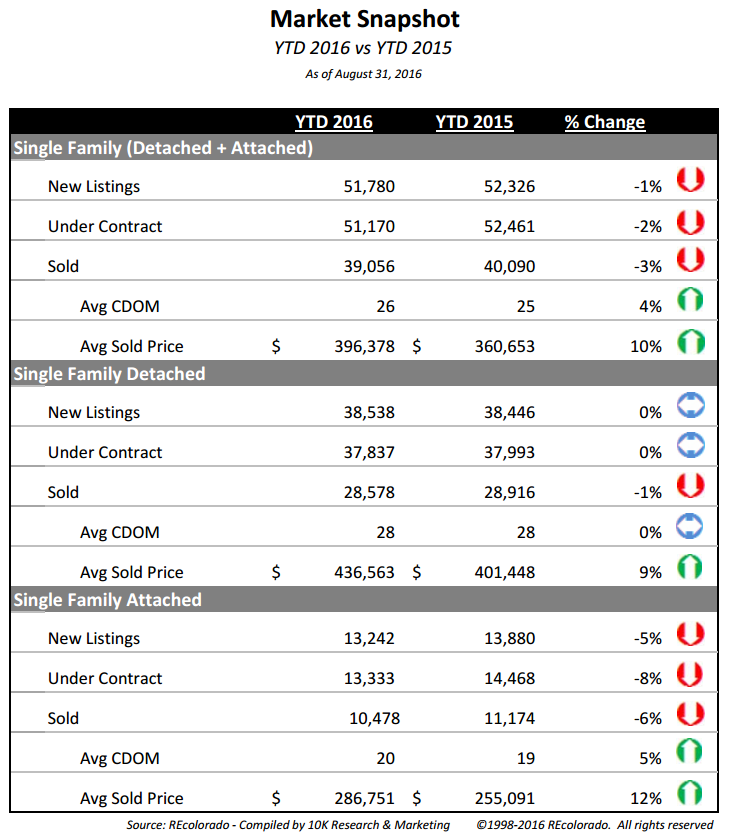

- The number of properties sold YTD in 2016 over 2015 has decreased 2.6%.

- The average price of a single family home in August of 2016 has decreased 2% over July of 2016.

- August 2016 average price over August 2015 is up 10%.

- Average Days on the Market is increasing, but still very attractive historically.

- The percent to list price remains at a very strong number with homes getting full price or above in the majority of sales.

What Does this Mean for Denver Real Estate?

- The slowing down of the housing sold data is a result of three factors:

- The Buyer Pool or wave of buyers is slowing down due to seasonality and lack of affordable inventory meaning the average sold price of a home at $408,406 has hit a level buyers are not as eager to move forward.

- Buyers income has not kept pace with housing appreciation.

- Lack of inventory in areas causes current homeowners to hold off from selling as they may not be able to replace their existing home with what they want.

- The number of sales for 2016 will be lower than 2015 or about 56,000 single family and condo’s closed for the year down from over 61,245 in 2015.

- Fewer Buyers entering the buyer pool will cause prices to stabilize.

- Sellers have gotten a little too aggressive on price and terms for the market, hence the inventory is starting tor rise.

- Different Price Points and Different Locations react differently in the Denver market. Understanding your neighborhood with accurate supply and demand sales will give homeowners a better picture for your specific home.

What Should Sellers Be Doing to Take Advantage of the Market?

- Price still dictates buyer behavior. If you want to close before the end of the year, price your home at or 1% below current market values to capture more buyers.

- Make your home a move in-conditioned property. Buyers are unwilling to buy fixer uppers at top dollar.

- Consider prepaying for HOA fees or other concessions for buyers to differentiate your home from others when marketing.

What Should Buyers Be Doing to Take Advantage of the Market?

- Leverage your purchase with the lower rates now versus waiting even into 2017.

- Investors look at the entire Denver market as one of the best to own real estate. We encourage buyers to consider buying now versus waiting for both a primary residence and/or investment property.

- If time permits, do a pre-inspection before buying. This will give you enough data to make an informed offer on your purchase, that gives the seller enough information to accept a more favorable price to you, as the buyer.

Good Selling and Buying!

So, How’s the Market, September 2016. All data taken from REColorado on September 16, 2016. Denver, Colorado.