Third Quarter 2016 Real Estate Review

• The first three quarters of 2016 for real estate in Denver, CO experienced all of the same aggressiveness as the last 3 quarters of 2015. Bidding wars for houses, prices rising and inventory at historical lows for The Denver metro area. However, the tide is changing.

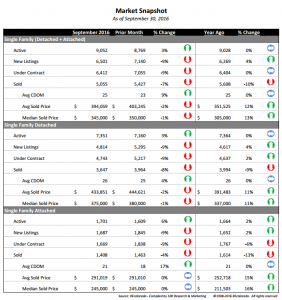

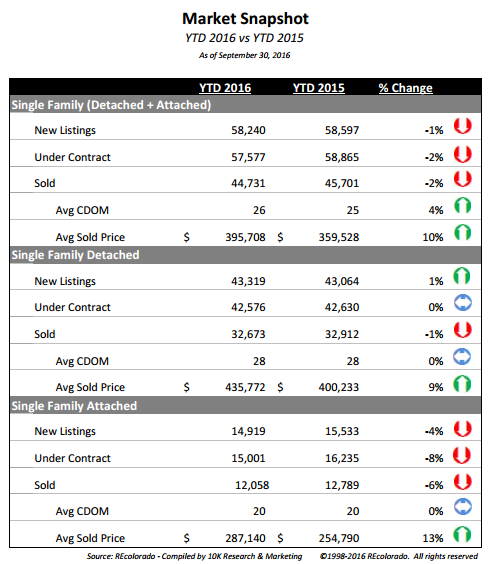

• There are currently 9,028 Active Single Family and Condominiums as of today or .3% more listing than 12 months ago. For the 1st three quarters of 2015 compared to 1st three quarters 2016 the total number of listings taken is 3.7% higher today.

• At the end of 1st three quarters of 2015 the Average Price was $$351,525 vs. the end of 1st three quarters 2016 the Average Price is $394,059 a 12.1% increase in one year. Median price went from $305,000 to $345,000 or a 13.1% increase indicating there just are not many lower priced homes on the market today.

• The Days on the Market in 1st three quarters of 2015 was 25. Today it’s 25 days on the market giving the impression the market is performing like it did. However, the number of homes that went under contract in 2016 is having an approximately 20% contract fall out rate compared to 9% one year ago. This is indicating a trend of buyers making an offer, then having some second thoughts after contracting. This is the first sign of a market starting to slow down to a more normalized selling pace.

• The Luxury Market is where the buyers can negotiate better positions when moving up in price point. For single family homes priced above $1 Million Dollars, the month supply of homes is 9.3 months. As you get higher in the luxury market the month supply increases. For single family homes price below $1 Million Dollars, the month supply of homes is 1.6 months. As the prices get lower, the month supply goes down. No question, the prices of home below $350,000 will continue to rise and the prices of homes above $1 Million will decrease in price from today through the first half of 2017 and potentially beyond.

What Does the Future Hold for Denver Real Estate?

• Appreciation to continue at a slower rate moving forward.

• Interest Rates will rise in toward the end of the year and into 2017 causing housing inventory to increase and sales to slow down.

• The opportunity to move up to your dream home could not be at a better time than NOW!

What Should Buyers Do in Today’s Market?

• Be Ready To Buy! Be pre-approved to make a competitive offer.

• Know you will have more room to negotiate moving forward and you should understand the condition of your new purchase very well.

• Real estate is very localized to neighborhoods. Study the data from the area you want to live and compare the research for that neighborhood over time to understand the trends.

What Should Sellers do in Today’s Market?

• Be positioned as the best conditioned home. You will get top dollar this way.

• Appraisals haven’t quite caught up with the buyer willingness to pay. Have a strong strategy to get your home appraised before taking it off the market on the highest offer.

• It’s October, make your home winterized from the street to the landscaping to attract the most traffic possible in the first few days and get some of that overgrown look removed as things start to hibernate!!!

So, How’s the Market, October, 2016. All data taken from REColorado, on October 11, 2016. Denver, Colorado. All data taken from the 8 county Denver Metro Area only.