How Hot is Denver Real Estate?

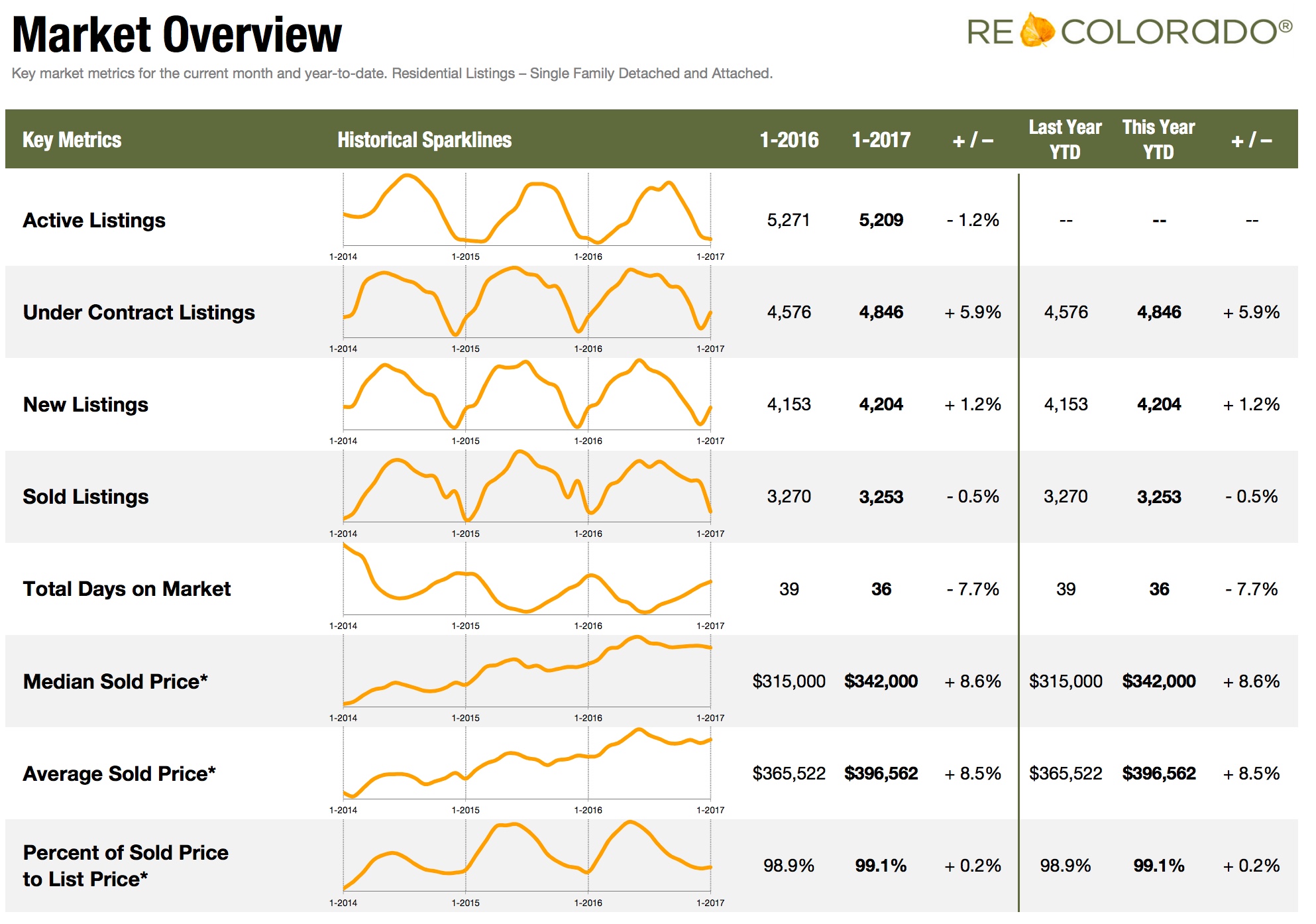

- February 2017 continues some of the lowest inventory of single family and condo recorded for the last 25 years. Total Active listings today is reporting 5250 compared to 5312 twelve months ago, a slight decrease, but still remaining low and a bonus for sellers. The number of closed properties for January 2017 has increased year over year with 3524 single family and condo homes closed. The number of homes under contract month over month has increased 16.98%.

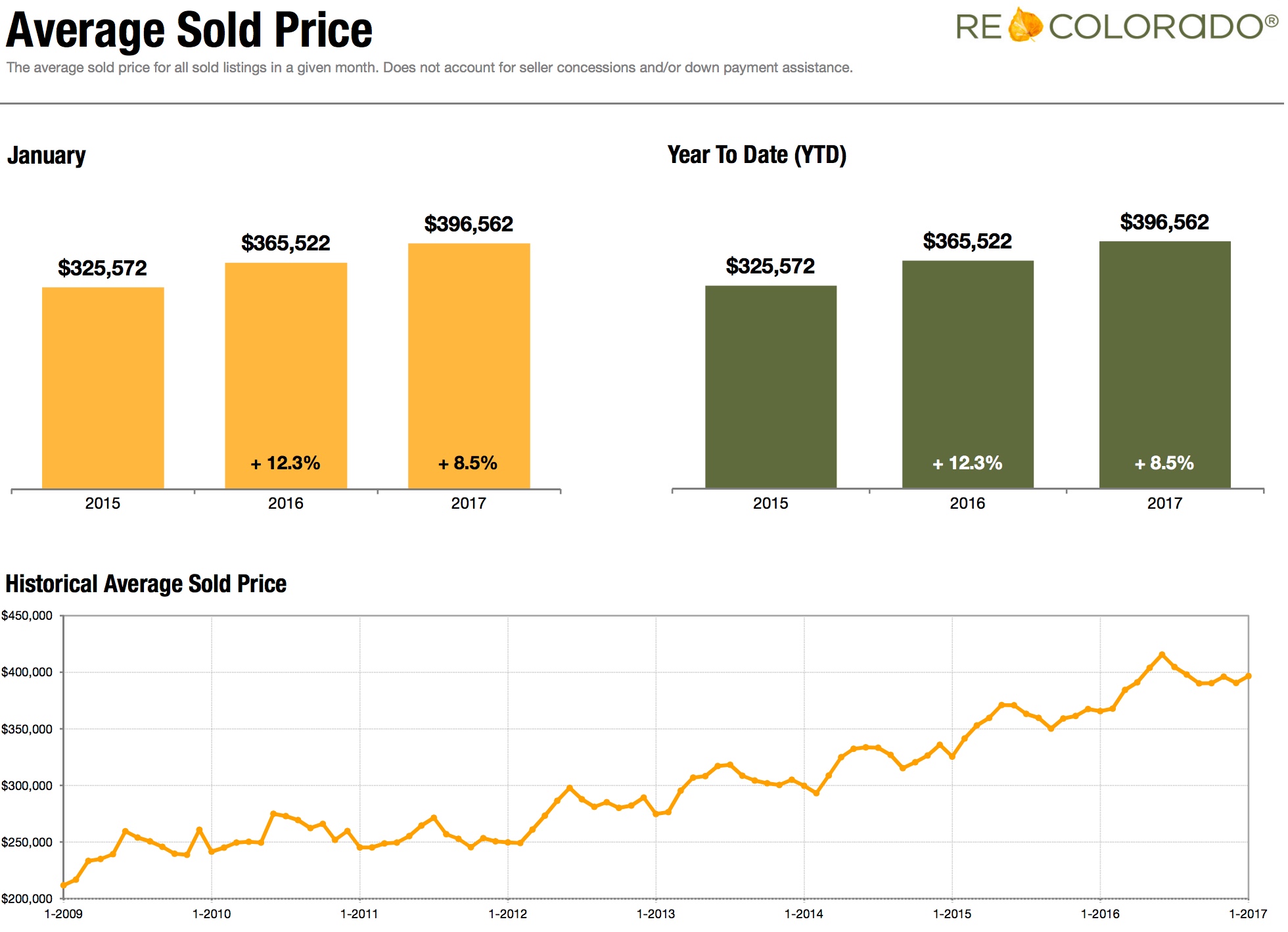

- This is a staggering trend indicating the buyers are still entering the market in the early part of 2017. Why is this continuing? Primarily due to low inventory and low interest rates. The average price of a home today is $396,028 compared to $364,048 one year ago. An 11.8% increase. The Days on the Market has remained constant over one year ago and today stands at 34 days on the market.

Can The Aggressive Sellers’ Market Continue through 2017?

Three Factors to Watch in 2017:

- Interest rates for mortgages remain at low levels. The Federal Reserve has slowly been increasing the fed rates and they will continue their policy of lower rates for the short term, but not necessarily through the end of the year. This will allow buyers to continue to have a buying power this spring. However, the lack of inventory that has created a buyer-frenzy which is causing buyers to continue to bid prices up, may be slowing down this year compared to the two previous years. Buyers historically start a bidding war when the market moves up in price and the choices are not available to go a different direction. However, with some future uncertainty, their buyer behavior could change to “a wait and see approach” vs. “a bid higher mentality”, causing inventory to continue to rise and sales to slow down through the spring/summer season.

- Obtaining a loan is becoming easier for buyers with alternative lower down payment type loans available in the marketplace that were not available 24 months ago. This will continue the stream of buyers into the market continuing a sellers’ market.

- Employment growth and stability in the overall economy bodes well for Denver housing to continue at the same pace for at least 4-6 months. Sellers will have the upper hand in the price ranges with inventory levels below 3 months of supply.

Overall the market will decrease in units closed from 2016. Today’s market offers a very unique opportunity in that the lower price homes below $750,000 are rising in price and homes in selected suburban homes priced above $1 million are not rising at the same pace. The buyer in the luxury market can really get a great value by purchasing in the next 90 to 180 days. This window will close as inventory in the luxury market continues to decrease in inventory.

One concern in the marketplace is the rapid rise of prices year over year. If we continue to see flat inventory through the next 3-6 months with prices continuing to rise at approximately 1% per month, the average individual income will not be able to keep pace, causing a flattening of prices later this year or even a correction of prices. The next 3 months will give additional trends to better predict 2016 prognostics.

What Should Buyers Do in Today’s Market?

- Be Ready To Buy! Homes below $500,000 are moving quickly.

- Know you will not have much room for negotiations during inspections. Understand the condition of your new purchase very well.

- Real estate is a very localized product to neighborhoods. Study the data from the area you want to live and compare the research for that neighborhood over time to understand the trends.

What Should Sellers do in Today’s Market?

- Be positioned as the best conditioned home. You will get top dollar this way.

- Appraisals haven’t yet caught up with the buyer willingness to pay higher than list prices. Have a strong strategy to get your home appraised before taking it off the market on the highest offer.

- It’s February, make your home front sparkle from the street to attract the most traffic as best you can.