Join us as we look at the real estate market from 2023 and go over projections for 2024!

2023 Annual Review

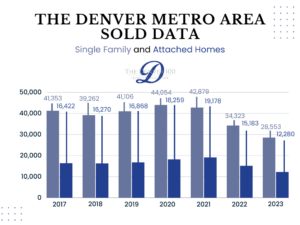

Sold Homes

This was a continued reduction in the number of homes sold as 2021 experienced sales of 62,047 creating two years of the buyer pool shrinking at abnormal numbers.

Standing Inventory

Median Price

Our data shows that sellers, on average, sellers were contributing approximately 3% of the sales price for concessions. Of course, this effects the seller’s bottom line by that amount less than what was happening in 2022.

Average Days in MLS

The weeks of supply are now at 8 weeks, which is reflection of fewer buyers entering the market meaning the market is slower to move properties than 2022.

Price Position Matters

What does this mean?

Buyers were willing to buy homes if the price position was close to true market value and sellers were willing to negotiate through the terms of contracts. Ultimately, the price position a seller starts with dictates the sellers ability to obtain top dollar due to market conditions.

Price Range

$500,00 to $750,000

Single family homes in this price range had the most home sales with 13,754 homes closed in 2023 creating an absorption rate of 6.8 weeks of inventory.

$1.5 million +

Single family homes in this price range registered a total of 1,548 homes closed in 2023, creating a current absorption rate of 7 months supply of homes. This is an increase of 86% of time for a home in this price point on average will be absorbed by the current market trends or 5 months longer than the price range of $500K to $750K.

The Denver Real Estate 7-Year Cycle

Sold Data

- The Denver marketplace came out of a slow growth period of sales from 2012 to 2017.

- Increased sales occurred for 5 years, then fell off to below normal numbers the last 2 years.

- This 7-year period will be looked upon as the highest level of appreciation achieved by homeowners in terms of increased values than in any previous 7-year period in the Denver market place.

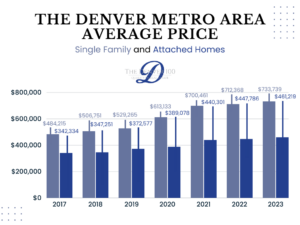

Average Price

- 42.9% rise in the average price of all properties in Denver for the last 7 years makes homeowners very happy with their newfound equity position.

- The current market is making an adjustment as the increased prices will not be sustained due to the average buyer’s income not keeping pace with home prices.

- A typical 10-year cycle would see a 30% increase in the value of an average home and the 43% increase for the most recent 7-year period has created a wealth position for homeowners much above an average period.

2024 Housing Market Projections

Active Listings

- The Market suggests Active Listings will be 8,000-9,000 homes. Although, if inventory levels remain low in the 5,000 to 6,000, there could be appreciation in 2024.

HOWEVER

- The Market suggests interest rates for home mortgages will continue to be somewhat volatile through 2024. Overall, the marketplace will offer lower interest rates with a 50 to 75 basis point difference in 2024 from the end of 2023 assuming no major economic challenges.

Sold Homes

- The number of homes closed for 2024 will increase approximately 10% or 45,000 home sales.

- From January – June of 2024, there will be a flattening of market prices and sellers will still provide some level of concessions until rates subside.

HOWEVER

- Higher impact fees of HOA dues, insurance costs and property tax costs will cause an affordability issue. Prices will remain static without a reduction in interest rates for buyers to afford to buy.

- The First Time Home Buyer Pool will increase in 2024 and makeup a larger percentage of the entire market for Denver in 2024, as Millennials find stability in jobs, relationships and reduce personal debt, they will be the purchasers of homes in 2024.

- 2024 will bring families together in generational home designs.

Thank you for allowing The Denver 100 to be your resource for the Denver Housing Market. We are grateful for the opportunity to serve your real estate needs in 2024!