Denver Metro Area Single Family Housing

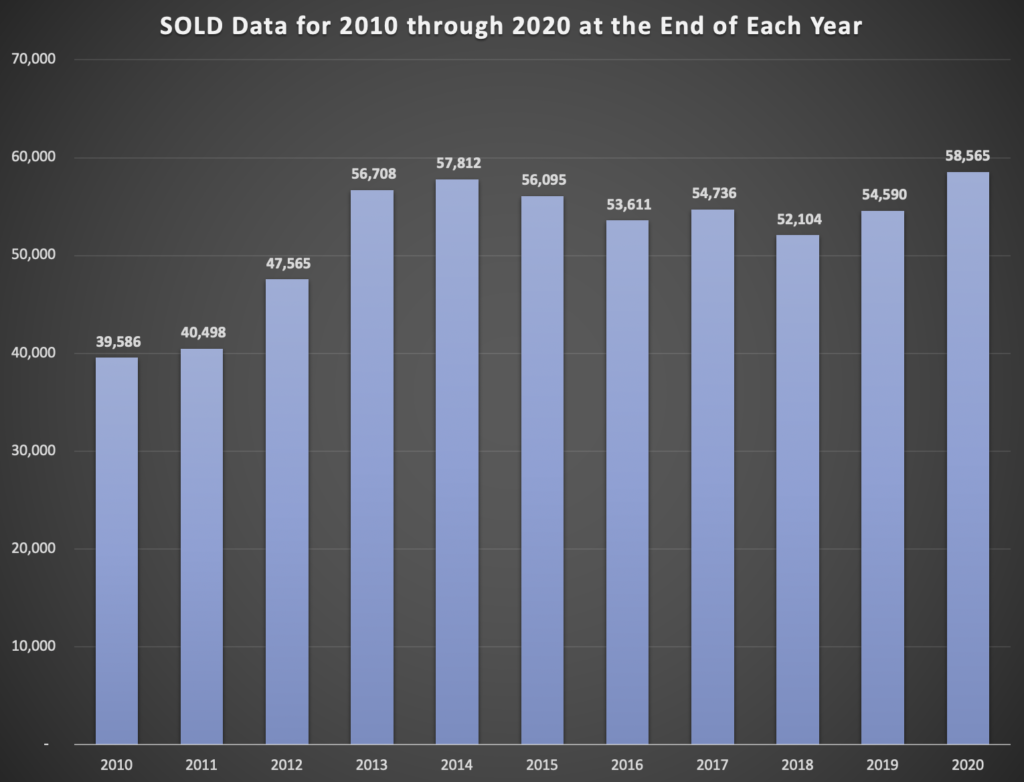

• 58,565 single family and condominiums/townhomes sold in 2020 compared to 54,590 that sold in 2019 or a 7.3% increase in the number of homes closed.

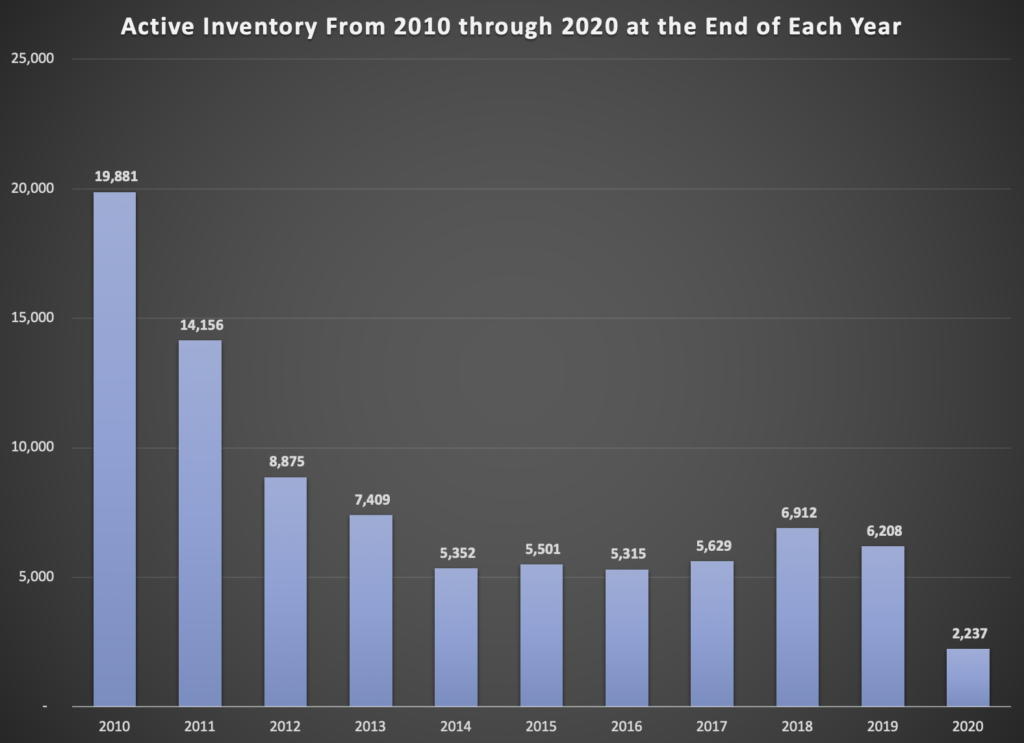

• At Year End 2020 there were 2,237 active homes for sale compared to the end of 2019 which had 4,395 homes – a decrease of 49.1% of inventory over last year at this time. This decrease of inventory suggests the Denver real estate market is still a sellers’ market and performing at a higher than normal level for 2020.

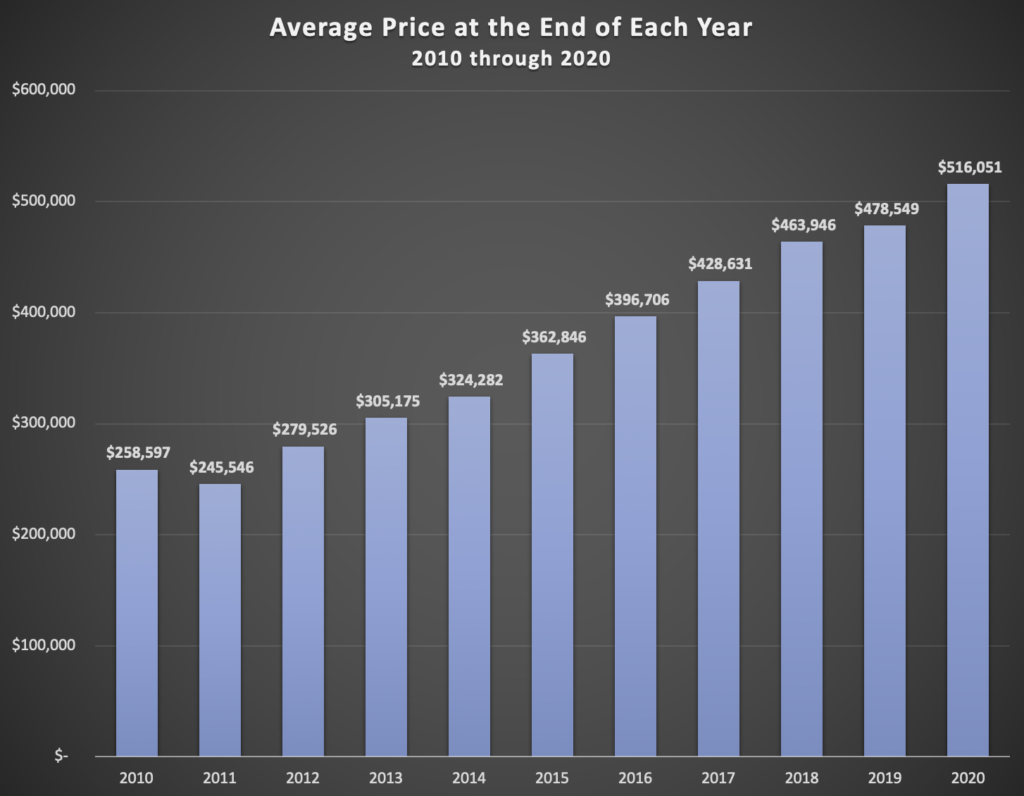

• The average price of a home in the Denver Metro Area ending 2020 is $516,051 compared to $478,459 ending 2019 year, which is an 7.84% increase in price for the mix of properties sold. By comparison, 2010 had a single family average price in Denver of $258,597.

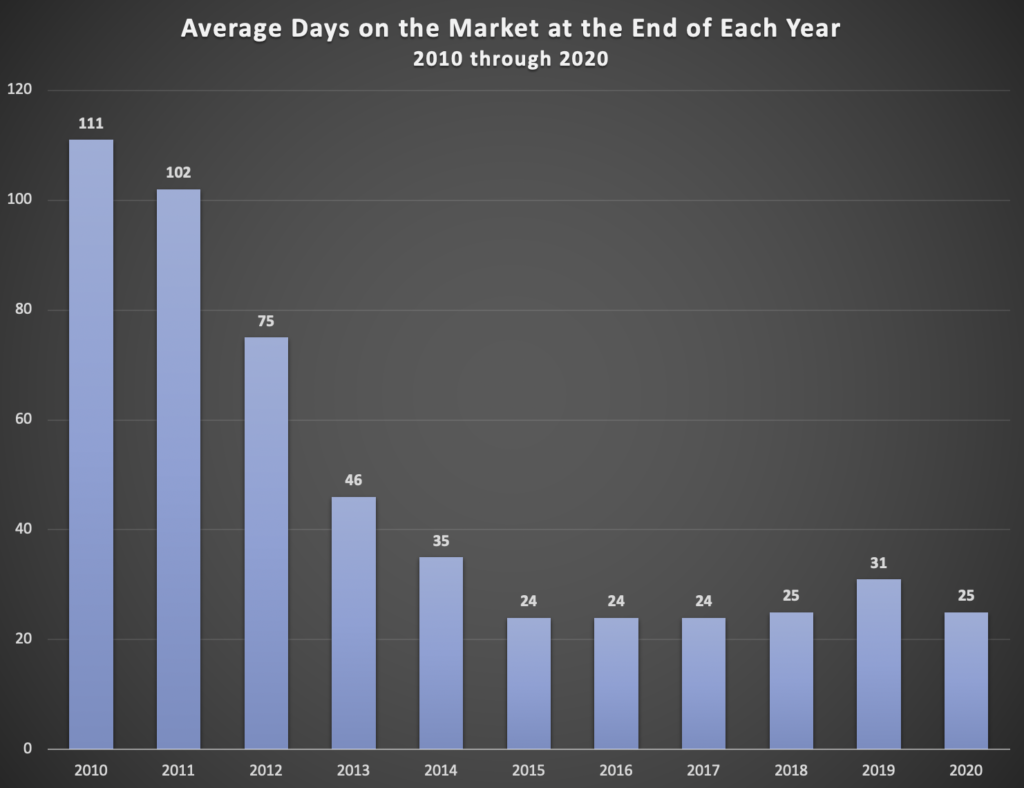

• The average days on the market for 2020 is 25 compared to 31 one year ago.

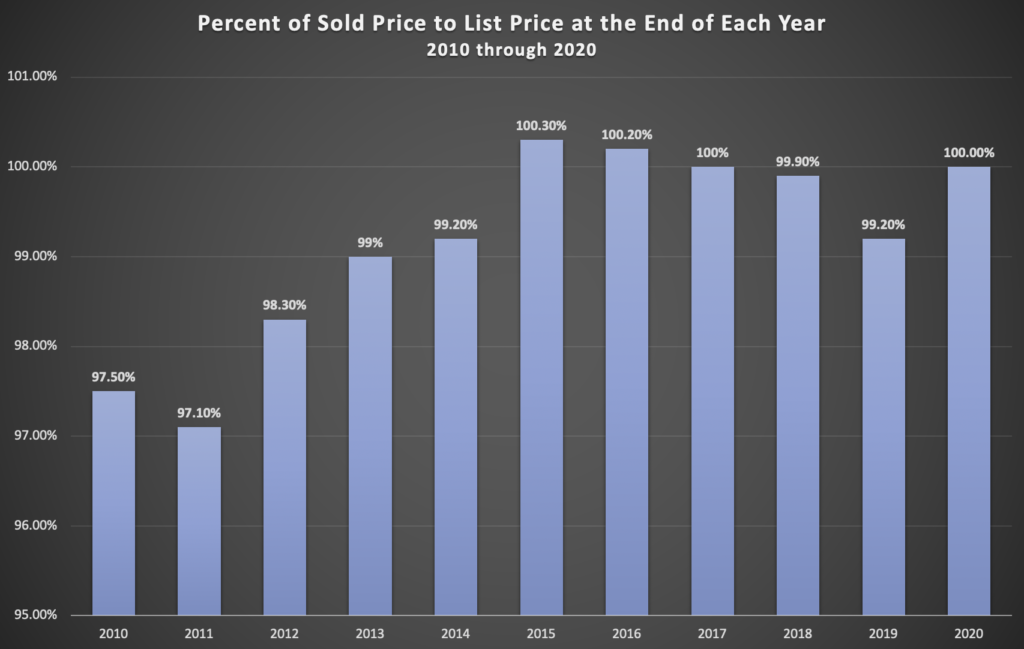

• The selling price obtained compared to List price is 100%. What this means is that buyers were willing to pay close to full price or more to buy a home in 2020, and this figure increased from earlier months where the pandemic had many fewer buyers entering the market.

• The absorption rate for single family homes in the Denver Metro Area with 2020 year-end inventories is a 14 day supply as of January 18th, 2021. As the inventory increases so does

Price Points in Housing Changes Demand

- The $250,000 to $500,000 price range had the most detached home sales with 21,999 homes closed in 2020 creating an absorption rate of 6 days of inventory. Below 6 months of inventory typically indicates prices will continue to increase.

- Conversely the $1 million and above price range had a total of 2906 homes closed in 2020, creating a current absorption rate of 1.54 months of supply. This is a decrease of 66.2% in supply from 12 months ago, and moving in the direction to have luxury property owners re-enter their homes to the market causing a greater inventory in 2020.

Do You Wish You Would Have Bought More Real Estate in 2010?

Don’t wish the same thing in the year 2030!

In the last decade inventory has decreased 887%. This has created the Denver real estate market to be one of the most outperforming markets compared to national marketplaces. Watching the inventory will give you a very visual picture for the future real estate performance in Denver. We see inventories growing slightly year over year by as much as 300% in 2021 to 6000-8000 units, and future years will rise to levels as demand decrease. However, until the inventory rises above the 10,000 unit level, the demand for housing will remain strong.

Total Number of Homes Closed Increased 47.94% over the last Decade!

In the recent decade, the number of units closed has gone from 39,586 in 2010 to 58,565 in 2020. This increase represents a 47.94% increase in closed units. As the inventory will rise in 2021 and beyond, the number of units closed will decrease slightly over the next 5 years as buyer demand decreases. This is a normal recurrence in a real estate cycle as we are at 10 years of growth in closed units. This is unsustainable to continue, but 2021 does have more housing permits already pulled to build new homes, indicating the short term will not see very much of a decrease in the number of closed units for 2021.

Average Price went up 110% Since 2010

For The Last 10 Years Price has Gone Up in Denver Housing

- Overall Average Price Increased for all homes Sold by 110% since 2011.

- Single Family Average Price Increased by 105%

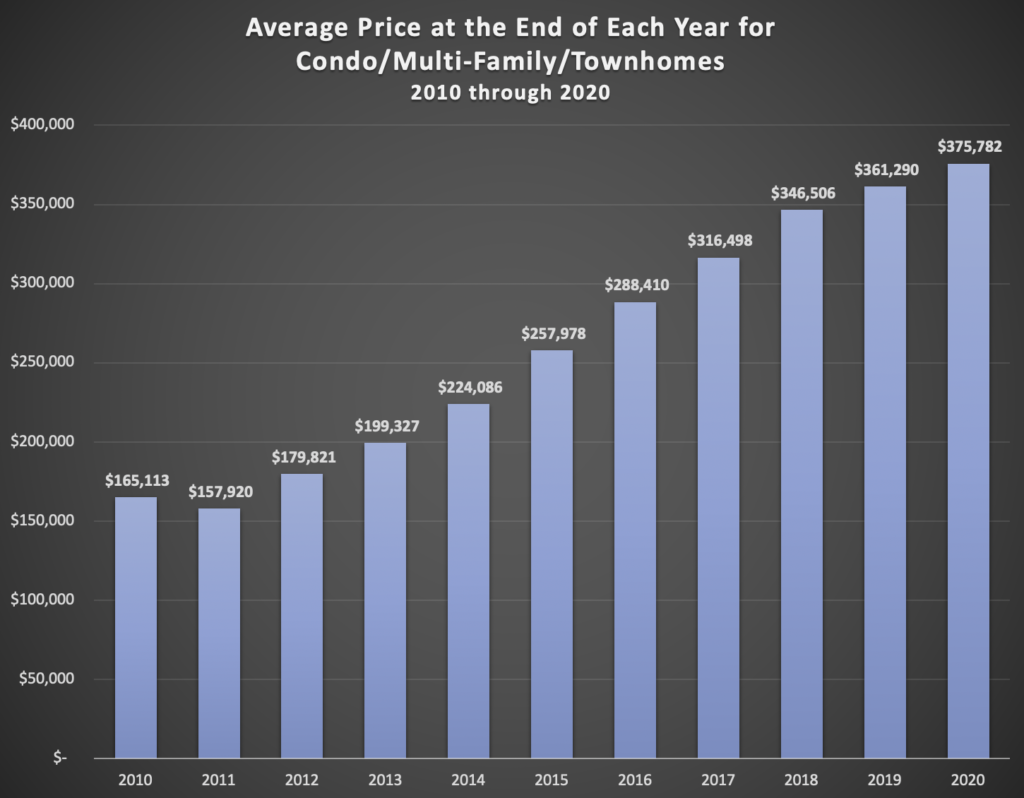

- Condo/Townhome Average Price Increased by 138%

A 110% rise in the average price of all properties in Denver since 2011 makes homeowners very happy with their newfound equity position. This wealth growth in housing for Denver is unprecedented and cannot be sustained due to the average buyers’ income has not kept pace with the pricing of property for the 8 county Denver metro area. More than 55% of homeowners have refinanced in the Denver market over the last 4 years. Some homeowners have taken cash out of their home and some have just refinanced the original debt. Either way, homeowners have lowered their monthly payments or created a cash pool that homeowners did not enjoy in 2011. Our recommendation is to only refinance the original balance into a lower rate and less of a term. For example, going to a 15-year amortized fixed rate may fit your long terms financial goals vs, refinancing into another 30-year amortized fixed rate and starting the time over.

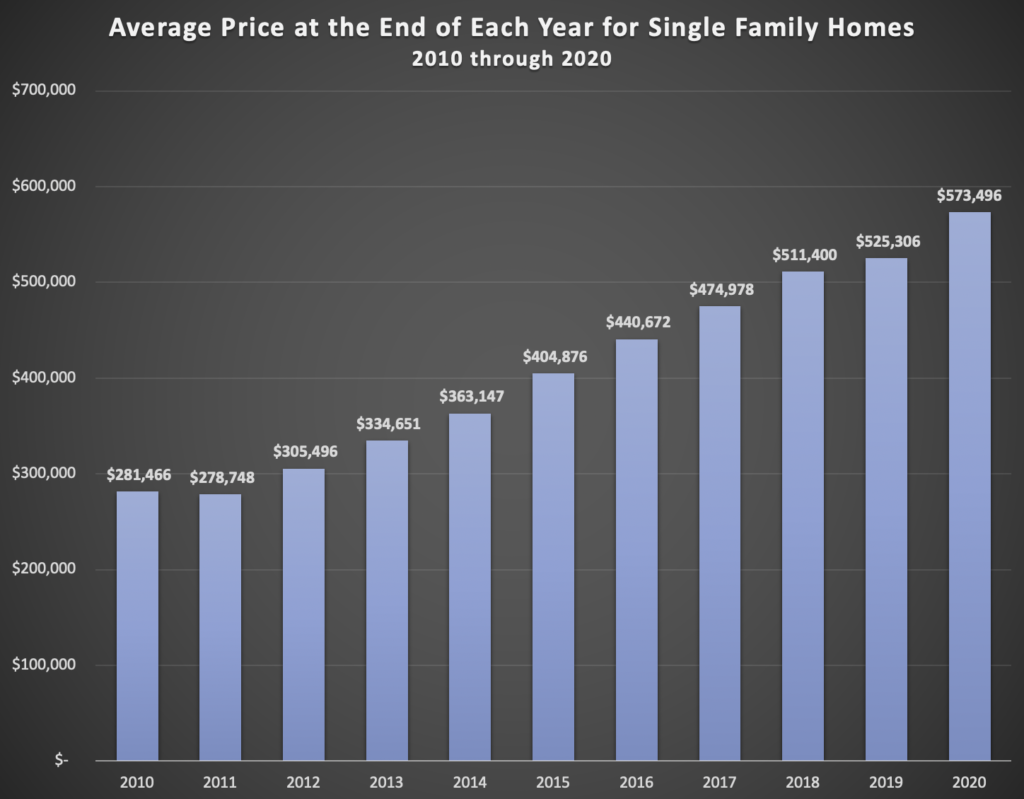

Average Price of Single Family Detached Homes

105% Increase since 2011

Average Price of Attached Homes

138% Increase in 10 Years

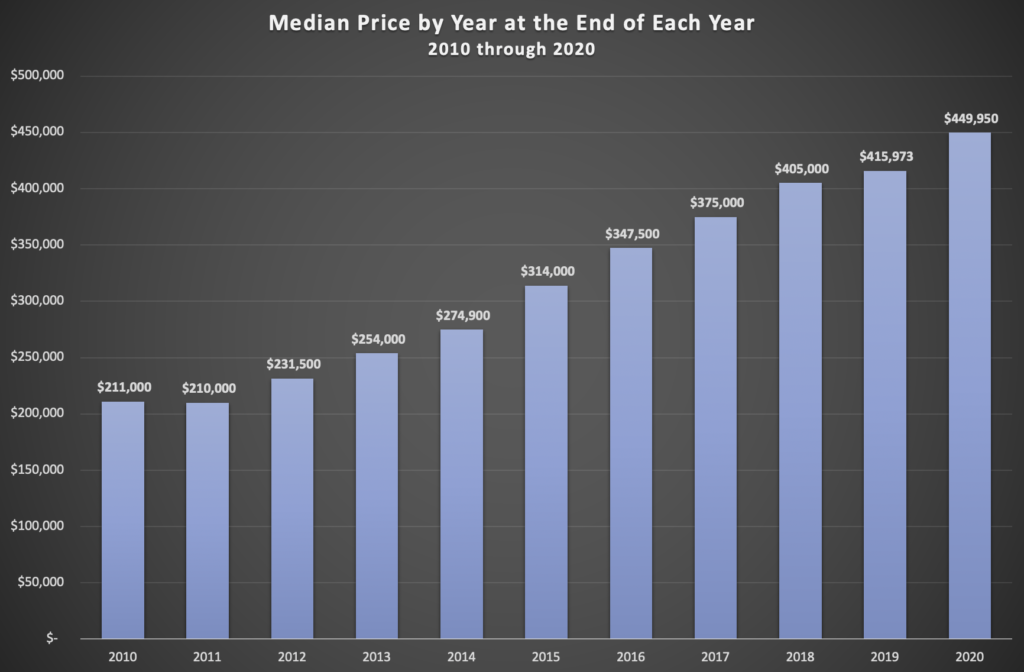

Median Price Increased 114% Since 2011

The median price chart reflects the middle of the pricing for homes in the Denver area, meaning that half the buyers bought above $449,950 in 2020 and half bought below. The affordable housing availability in Denver has been reduced by almost 100% in 10 years. This was escalated because of two main reasons:

- Construction Defect Litigation in the first half of the decade eliminated entry level attached housing from developers’ willingness to absorb that risk.

- The cost of materials, land, impact fees and labor for housing has exponentially increased over the decade causing even the lowest entry priced homes to feel the price impact. Interest rates have helped entry level consumers stay in the market to buy. We do see the 8 county Denver metro area becoming increasingly aggressive with adding Affordable Housing in all parts of town when approving a new platted area or rezoning an existing area.

Percent of Sold Price Says Denver is Still A Sellers’ Market

The percentage of sold price to list price over the last decade indicates that Denver real estate has held its value very well. We would suggest this trend to continue through the first 9 months of 2021 and values to grow at a slower growth pattern moving from 2021 to 2022. We would suggest a 30% increase in the price of homes in the 8 county Denver marketplace by the year 2030.

Average Days on The Market Decreased 77% Since 2010

Average Days on the Market is the result of having more buyers buying today than 10 years ago. You can see the trend drop due to the increased sales volume the last half of 2020 and we would suggest the average time on the market will increase as inventory rises in 2021. The primary reason for this increase, which would make a more normal marketing period, is there will be fewer buyers entering the market over the next year willing to pay the prices Denver real estate is currently demanding. A longer marketing period does not suggest prices will drop significantly as you can see in the chart titled “Percentage of sold price to list price” only fluctuated 2-3% over the entire decade.

2021 Housing Market Projections For The 8 County Denver Metro Area

1. The number of available properties to buy will continue to rise over 2020 levels on a gradual basis through the spring and summer then increase in the 3rd and 4th quarters of 2021. As the market normalizes with higher supplies of homes, appreciation of home prices will slow down, plus the time to market the home to a contract will elongate to approximately 40-45 days vs. 25 days.

2. Today’s home Prices have more than offset the negative adjustments made during the 2008 to 2012 years. There are a larger number of homes with substantial equity that can take advantage of refinancing to remove some of that equity that has been gained over the last 10 years. As interest rates start to rise in 2021, the refinance boom of 2020 will slow down and sellers may consider selling as the benefit to refinance may not be as great as it was in 2020.

3. Unemployment for 2021 is going to continue to be lower than the national average as we anticipate unemployment rates in the 8 county Denver metro area to be higher than past years. With the amount of entry level job losses and business closures in 2020 the unemployment rate for 2021 is fragile until a normalization of business can occur. The roll out of the vaccination to COVID-19 has been somewhat underwhelming at this writing, but we do suspect by June or July of 2021, the business market may start to re-open and some of the entry levels jobs lost during the shut down periods will slowly return.

4. Sales will decrease slightly for 2021 with total closed sales to be approximately 57,000 single family and condos sold for the upcoming year. The last half of 2020 experienced an abnormal increase of buyers entering the market due to low interest rates, stability in their personal economic situation and housing prices that continued to rise at above average levels. The buyers didn’t want to miss their opportunities when the rates dropped in the summer of 2020 . As the inventory of single family and attached homes closed in 2020 decreased year over year, 2021 will be 4-6% less in number of units closed, which would still make 2021 one of the highest number of sales in a decade.

a. The primary reason the housing market will see fewer buyers in 2021 is that

i. Interest rates will be higher than they are today and we predict 3.5+% to occur in 2021.

ii. Secondly, the easing of the borrowing guidelines still requires such rigid proof of ability to buy that self-employed or newly employed workers do not meet most of the guidelines causing the buyer pool to retreat some in 2021.

iii. The inventory of properties will continue to grow to more normal levels, causing buyers to have more choices. The more choices, the less likely the buyers are to “rush” to a purchase.

These three reasons are the “why” of the number of units predicted to close in 2021 to be less than 2020.

5. Prices of homes below $500,000 will increase approximately 5% in 2021 depending upon the location. We do not see any prices of homes below $500,000 reducing in 2021 unless a major job loss occurred in one area, like the airport losing lots of jobs, causing the housing in that particular sub area being affected by an economic occurrence.

6. Prices above $500,000 had a great year in 2020. We see the number of units sold in 2021 to remain constant with 2020 up to $2M depending upon the geographic location of a home.

7. Location will always dictate the pricing of homes. For example, a $750,000 home in Arapahoe County is liable to go up and sell at a faster rate than the same $750,000 in an inner city home in Denver. Why would this be? It goes back to the comfort level of the buyer pool who will pay more for location than worry about value. The suburbs with more housing space have become a commodity in 2020. We saw a trend from the summer of 2020 to January of 2021 a migration towards suburban living. The “Work at Home” scenario has caught on and although we see it taking different turns in 2021, there is a large buyer pool segment that is looking for more home office space than ever before. We have also seen a trend to generational housing in 2020. This trend will continue and increase the value of home ownership in the suburban markets

8. The Luxury Market is stable and in the new luxury home market, the product price is increasing faster than the resale homes. Buyer behavior has changed as to what the buyers utilize in a luxury home and the buyers are more interested in convenience than mega mansion size. This has been proven in 2020 as new product luxury homes sold data is at record prices, while resale homes have sold at approximately 70% of new product sales across the suburban markets. The spread in price between the two types of product is significant and luxury buyers, looking at suburban sub areas will find very reasonable price points in the resale market compared to newly built homes.

9. The First Time Home Buyer Pool will increase in 2021 and make up 40% of the entire market for Denver, as Millenniums find stability in jobs, relationships and reduce personal debt, they will be the purchasers of homes in 2021. This will mean about 22,000 sold units will be to first time buyers. What will they buy?

A. Attached homes will be the first choice for this group, as the prices are more attractive than the entry level detached or single-family home. However, there is a trend with Millenniums moving to a more suburban feel with an urban type environment. Many of the city centers around the Denver 8 county area are experiencing increased first-time home buyer activity and are predicting much more in 2021.

B. There are more suburban apartment complexes today than ever before. This allows the entry level buyer to experience suburban living before buying. The rental pool tends to be entry level buyers and with more of them renting in suburbia they will tend to buy in the same locale.

10. Multi-Generational Family buyer pools are emerging in Denver. This buyer group has proven successful in buying homes in other U.S. cities and is now a target group that is emerging within our communities of the suburbs of Denver. This group is made up of grandparents, parents and children buying together. When you have a downsizing “Baby Boomer” population that has equity in their home and wealth in portfolios, that want a more mobile lifestyle added to a growing buyer pool of Gen X to Millennial population that have working income but no equity creates more families living together. This combination fits a select group of today’s population. Homes offering multiple housing options within a singular property, such as homes with lower level full living spaces, i.e. second kitchens etc. will be attractive to this group.

All Data Compiled from REColorado MLS System on January 18th, 2021